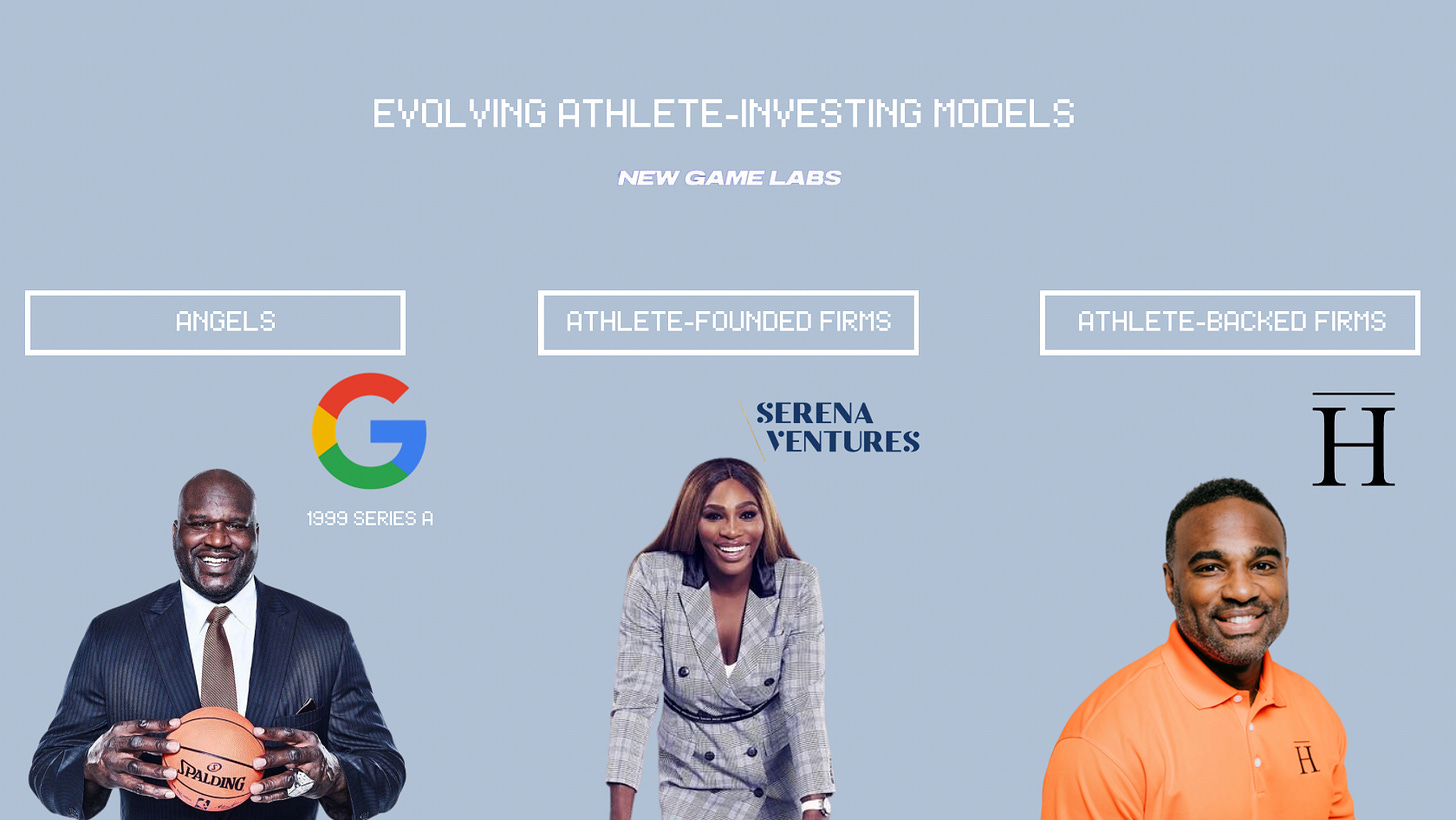

💡 Big Idea: Athlete-Investing Models are Evolving

The most common question I've received this year from startup founders is: how do we navigate raising from athlete investors?

Founders have more options to reach athlete-investors than ever before.

They can raise from athletes that are angel investors, athletes with their own VC firms, and collectives of athletes investing together.

The growth of athlete-investors was inevitable, but what’s interesting is how the models of athlete-investing are evolving and the opportunities that it opens up for startups.

2023 has undoubtedly been the year of the collective approach.

This week we’re looking at 3 examples of the collective model and sharing 1 big thing founders should know about this chapter.

💰Antimatter Business Partners

Antimatter Business Partners is a business management firm that helps professional athletes build wealth through venture capital, private equity, and access to unique ownership deals.

The firm is founded by Rashaun Williams who is bringing years of success on Wall Street and VC to “help the modern athlete invest like the owners” (via Sportico).

Williams, the Founder of Value Investment Group and a GP at Manhattan Venture Partners All-Star Fund has served as a trusted, pro-bono advisor to NBA players over the years.

Now building a firm around his efforts, he and the team have 100+ current and former athletes on board with ABP.

The firm has recently made investments into RecoverX, DriveLA, and more.

Learn more about ABP here.

💰APEX Capital

APEX Capital is bringing the collective model to the European market. In September, they announced the launch of a €50 million athlete-backed fund to invest at the intersection of sports, media and entertainment.

Antonio Cacorino, the Founder and CEO of APEX sees their network of 70+ athletes across F1, Formula E, Premier League, LaLiga, PGA, WSL, Boxing, Rugby Union, NFL, NBA as an integral part of the firm beyond capital.

Their goal is to bring the collective insight of their athlete-investors to guide their decisions and support their portfolio companies in the sports tech market.

The firm has made 15 investments to date including TMRWSports, ScorePlay and Playsight.

Learn more about APEX here.

💰Sequel

Sequel is infusing the collective model with a tech forward approach.

Founder and CEO Alex Macdonald, who previously built Velocity Black — a startup that was acquired by Capital one in 2023, understands what type of value-add is important from investors.

“The #1 value add from any investor is distribution, and that's where I think athlete and other high net worths have a real competitive advantage against other investors”

Alex Macdonald via VC Stack

To drive this value add at scale the Sequel platform connects founders to PR, advisory, endorsement, and media opportunities from their athlete investors.

Learn more about Sequel here.

🔎 What Founders Should Know

The market of athlete-investing isn't crowded, it's just expanding.

As a reference, think about what’s recently occurred in the landscape of athlete marketing partnerships.

Prior to the NIL rule changes in 2021, the “addressable market” of athlete brand partners were the “2%” of professional athletes.

Now startups have the opportunity to partner with millions of athletes at both the professional and collegiate level.

This hasn't decreased the value of the athlete marketing partnership, but it has increased the need for a targeted approach to yield the best results.

The same thing is true when seeking athlete investors today.

What was once limited, is now democratized — startups have the opportunity to raise from athletes across various sports, geographies, markets of expertise and forms of value add.

It increases the need to get specific about what a startup is looking for in athlete-investors:

What investing model?

What types of athletes?

What audiences do they have?

What market expertise do they specialize in?

What forms of value-add do they provide?

🫂That’s a Wrap

Thank you for reading!

As always, let’s connect on LinkedIn to continue the conversation!

Kirby